The six-month average cars and truck insurance coverage premiums by gender are: Male: $734 (credit). 94As you can see, the distinction in premiums in between adult male and adult female chauffeurs is minimal, though gender does have an effect on premiums for young chauffeurs.

Sources: This content is developed and maintained by a 3rd party, and imported onto this page to help users provide their email addresses. vehicle insurance. You might be able to discover more details about this and similar content at.

The typical car insurance coverage expense for complete coverage in the United States is $1,150 per year, or about $97 per month (vehicle insurance). A 'complete coverage vehicle insurance' policy covers you in most of them (car insurance).

A common complete coverage insurance policy will not cover you and your vehicle in every circumstance - liability. There is no such thing as a "full coverage" insurance coverage policy; it is merely a term that refers to a collection of insurance coverage coverages that not just consists of liability protection but crash and thorough.

What is considered complete protection insurance coverage to one motorist may not be the same as even another chauffeur in the very same home. Preferably, full protection indicates you have insurance coverage in the types and quantities that are suitable for your earnings, assets and risk profile (cheaper auto insurance). The point of all kinds of vehicle insurance is to keep you from being economically messed up by an accident or event.

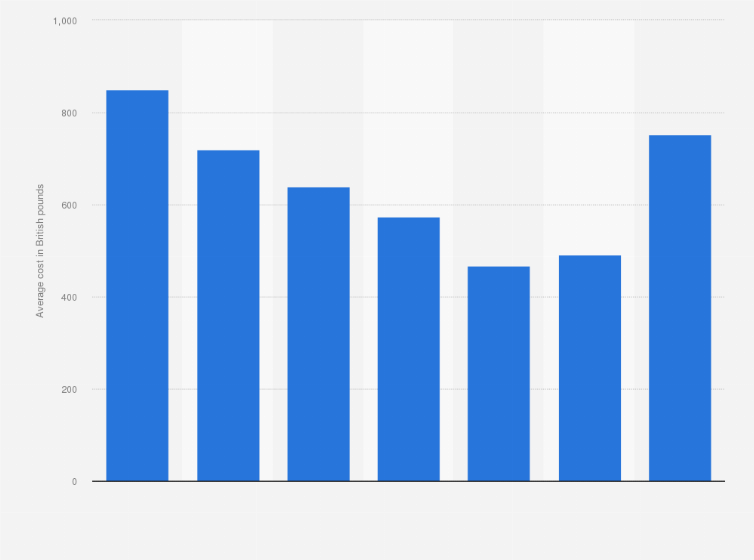

Rates likewise vary by hundreds or even countless dollars from business to company (insurance companies). That's why we always recommend, as your primary step to conserving money, that you compare quotes (cheap auto insurance). Here's a state-by-state contrast of the typical yearly cost of the following coverage levels: State-mandated minimum liability, or, bare-bones coverage required to lawfully drive a car, Complete protection liability of $100,000 per individual injured in a mishap you cause, up to $300,000 per mishap, and $100,000 for residential or commercial property damage you trigger (100/300/100), with a $500 deductible for comprehensive and accident, You'll see just how much complete coverage car insurance coverage expenses monthly, and each year. perks.

The average yearly rate for complete coverage with higher liability limits of 100/300/100 is around $1,150 more than a bare minimum policy (car insurance). If you choose lower liability limits, such as 50/100/50, you can conserve but still have decent protection - insurance. The typical regular monthly cost to improve coverage from state minimum to complete coverage (with 100/300/100 limits) is about $97, but in some states it's much less, in others you'll pay more.

What Does How To Save 'Hundreds' On Your Annual Car Insurance Payment Do?

Your cars and truck, as much as its reasonable market price, minus your deductible, if you are at fault or the other chauffeur does not have insurance coverage or if it is damaged by a natural disaster or stolen (compensation and collision)Your injuries and of your passengers, if you are struck by an uninsured vehicle driver, up to the limits of your uninsured motorist policy (uninsured vehicle driver or UM) - business insurance.

Full coverage car insurance policies have exclusions to particular occurrences. Each complete cover insurance plan will have a list of exclusions, indicating items it will not cover - cheap car. Racing or other speed contests, Off-road usage, Usage in a car-sharing program, Catastrophes such as war or nuclear contamination, Destruction or confiscation by government or civil authorities, Utilizing your automobile for livery or shipment purposes; company usage, Intentional damage, Freezing, Wear and tear, Mechanical breakdown (often an optional coverage)Tire damage, Products taken from the cars and truck (those may be covered by your homeowners or occupants policy, if you have one)A rental cars and truck while your own is being fixed (an optional coverage)Electronic devices that aren't permanently connected, Custom-made parts and devices (some percentage may be defined in the policy, however you can usually add a rider for greater amounts)Do I need full protection cars and truck insurance? You're needed to have liability insurance coverage or some other evidence of financial obligation in every state. cars.

Your insurance company won't pay more than your limit. Liability coverage will not pay to repair or replace your automobile.